Our Financial Planning Process

As your financial planners, we:

- Assess your financial situation and analyze the adequacy of your assets to support your present and future lifestyle

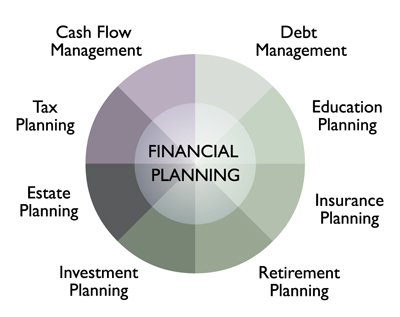

- Develop steps for achieving your financial goals, including:

- Determining an appropriate and dependable investment strategy to enable you, for example, to save for your child’s education, a new home or a comfortable retirement

- Employing tax strategies to lessen your overall expenses

- Helping you to organize and simplify your finances

- Assessing risks to your stated financial goals and putting plans in place to provide a legacy for your loved ones

- Implement your financial plan

- Monitor your plan and investments on an ongoing basis

- Help you make prudent financial decisions after life-altering events, such as divorce, illness or employment change

- Work with a network of professionals with expertise in the following areas:

- Tax, family and estate law

- Accounting

- Banking & Mortgages

Traditionally, we are paid by the financial institutions who manage our client's portfolios. Alternatively, we can discuss a fee-based approach.

Ongoing Monitoring and Accessibility

Your investments are regularly monitored. At your regular meetings we will review the performance of your investments and your financial plan.

DISCLAIMER: Desjardins Financial Security Investments Inc. (“DFS Investments”) is not providing the financial planning service and will not be supervising this activity. You should not rely on DFS Investments for review of the plan. DFS Investments is neither charging nor being paid any fees for this service and will not be liable for any errors or omissions. This financial planning service is done solely through Trio Financial Planning.